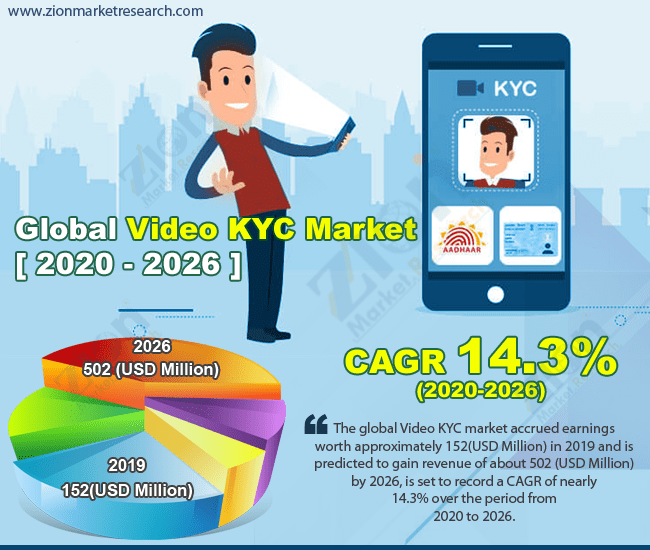

The global Video KYC market earned roughly 152 (USD Million) in 2019 and is expected to earn approximately 502 (USD Million) by 2026, with a CAGR of nearly 14.3% between 2020 and 2026.

The study provides a global and regional assessment and analysis of the Video KYC market. The report provides an in-depth analysis of market competition, restraints, revenue forecasts, opportunities, changing trends, and industry-validated data. The research includes historical data from 2017 to 2019, as well as a revenue prediction from 2020 to 2026. (USD Million).

Overview

Video KYC is a means via which end-users can perform KYC for their bank accounts in a matter of minutes. In this method, a bank officer checks the customer’s KYC documents and documents their signatures via video call. In these times of the COVID epidemic, this approach by financial institutions has assisted clients in avoiding visits to banks or preventing the requirement of physical presence at banks. The advent of AI, AR, Machine Learning, and VR, as well as the need for detecting and analyzing acquired data, has resulted in a massive need for Video KYC operations in the following years.

Furthermore, geotagging, facial recognition and liveness identification necessitate Video KYC in order to determine the profile’s legitimacy in a matter of minutes. Aside from that, it can identify geographical sites while gathering data and do parallel inspections using easily accessible databases. Video KYC appears to be built on three technologies: geolocation, cloud storage, cloud solutions, AI, and OCR. In addition, completing video KYC entails obtaining customer consent, confirming the customer’s location, determining liveliness, recording and validating id proof, and capturing and matching the customer’s face.

Read Related:

https://www.zionmarketresearch.com/news/video-kyc-market

Market Growth Dynamics

Due to COVID problems, the increasing demand for financial institutions, both public and commercial, to build virtual tools for dealing with clients has increased the use of Video KYC in recent years. Aside from that, video tools aid corporations in gathering consumer data and make it easier for retail banks to obtain legitimate KYC information. Furthermore, automation methods can help corporate organizations incorporate external data service providers, KYC utilities, and public registers into KYC operations. This is anticipated to lead to an increase in video KYC penetration in various financial institutions and Fintech firms throughout the world. All of these variables will contribute significantly to the overall market size in the future years.

Furthermore, escalating the need for making KYC utility cost-efficient has become a challenging task and this has created a growing demand for value-added services such as Video KYC. This, in turn, will expand the scope of the video KYC market in the foreseeable future.

The Asia Pacific market will grow at an exponential rate between 2020 and 2026.

The banking industry’s increasing need to enhance its macroeconomic growth, increase profit margins, expand its customer base globally, and increase investments will result in the expansion of the Video KYC industry in Asia Pacific between 2020 and 2026. Financial organizations in the region are concentrating their efforts on the development of digital-based and data-driven technology. This will almost certainly result in market penetration throughout the Asia Pacific in the next years. Demand for increasing efficiency, optimizing capital, and pursuing strategic expansion will pave the way for the subcontinent’s company in the next years.

An increase in lending activities such as SME enterprise lending activities & retail lending activities, as well as thriving wealth management activities, will define the industry landscape in the region. Efforts made by the regional government in the creation of customer-centric technologies will result in a market upswing in Asia Pacific during the forecast period.

Key players profiled in the study include Wibmo Inc., Signicat, Ameyo, SignDesk, HyperVerge, Inc., FRSLABS, GIEOM Business Solutions, Shufti Pro, Onfido, Pegasystems Inc., IDnow GmbH, Signzy Technologies Private Limited, LeadSquared, and Great Software Laboratory.

The global Video KYC Market is segmented as follows:

By Deployment

Cloud

On-Premise

By Offering

Software

Services

By End-User

Banks

Financial Institutions

Telecom Companies

Government Entities

Insurance Companies

E-payment Service Providers

By Region

North America

The U.S.

Canada

Europe

France

The UK

Spain

Germany

Italy

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Southeast Asia

Rest of Asia Pacific

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of Middle East & Africa

Contact Us

Zion Market Research

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL-FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

Read Also: